Page [1.]

Page [2.]

Page [3.]

Page [4.]

Charles Lawrence Delaney II "Megeso"

Page [1.]

Page [2.]

Document 01: N-9089 Corporate name Traditional Abenaki of Mazipskwik and Related Bands Incorporated. Name of Registered Agent: Connie Brow (Contance "Connie" Lee nee: Brow born on April 19, 1944 in Swanton, Franklin County, Vermont to Leonard E. Brow and Flora Belle St. Francis/"Rita Florabelle", older sister to "Chief" Homer Walter St. Francis Sr.)

NOTICE: The address of 44 Liberty Street Swanton, Vermont

10 Wheeler Pond Round, Swanton, Vermont 05488.

The initial Board of Directors:

George H. Gormley - 516 Tabor Road in West Swanton, Vt. 05488

Connie Brow - 10 Wheeler Round in Swanton, Vt 05488

David R. Gilman - 10 Wheeler Round in Swanton, Vt. 05488

John K. Lawyer - P.O. Box 209 in St. Albans, Vt. 05481

Ina E. Delaney - R.R. #1, Box 2430 in Swanton, Vt. 05488

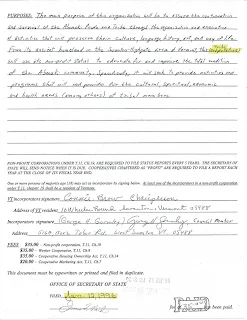

Document 02: Purposes of the Incorporation-The main purpose of this organization will be to assure the continuation and survival of the Abenaki People and Tribe through the organization and execution of activities that will preserve their culture, language, history, art, and way of life. From its ancient homeland in the Swanton-Highgate area at Vermont, this tribe (corporation) will use its non-profit status to advocate for and improve the total condition of the Abenaki community, Specifically, it will seek to provide activities and programs that will provide for the cultural, spiritual, economic and health needs (among others) of tribal members.

Vermont incorporator's signature: Connie Brow - Chairperson 10 Wheeler Round in Swanton, Vermont 05488.

Incorporator's signature: George H. Gormley - Council Member 516A, Box 2 Tabor Road in West Swanton, Vt. 05488

Office of Secretary of State: Filed January 12, 1996. Fee of $35.00 has been paid.

Document 03: N9089 Amendment to Articles of Incorporation of The Traditional Abenaki of Mazipskwik and Related Bands P.O. Box 309 Highgate Center, Vermont 05459. Dated July 30, 1996.

The following clauses are hereby made amendments to the original incorporation of the Traditional Abenaki of Mazipskwik and Related Bands dated Jan. 12, 1996:

---Notwithstanding any other provision of these articles, the Traditional Abenaki of Mazipskwik and Related Bands is organized exclusively for one or more of the purposes as specified in section 501(c)(3) of the Internal Revenue Service Code of 1986, and shall not carry on any activities not permitted to be carried on by an organization exempt from Federal income tax under IRC 501 (c)(3) or corresponding provisions of any subsequent tax laws.

---No part of the net earnings of the Traditional Abenaki of Mazipskwik and Related Bands shall inure to the benefit of any member, trustee, director, officer of the Traditional Abenaki of Mazipskwik and Related Bands, or any private individual (except that reasonable compensation may be paid for services rendered to or for the organization), and no member, trustee, officer of the Traditional Abenaki of Mazipskwik and Related Bands or any private individual shall be entitled to share in the distribution of any of the organization's assets on dissolution of the organization.

---No substantial part of the activities, all of the remaining assets and property of the Traditional Abenaki of Miazipskwik and Related Bands shall after payment of necessary expenses thereof be distributed to such organizations as shall qualify under section 501(c)(3) of the Internal revenue code of 1986, or corresponding provisions of any subsequent Federal tax laws, or the Federal government or State or local government for a public purpose, subject to the approval of a Justice of the supreme Court of the State of Vermont.

---In any taxable year in which the Traditional Abenaki of Mazipskwik and Related Bands is a private foundation as described in IRC 509(a) the organization shall distribute its income for said period at such time and manner as not to subject it to tax under IRC 4942, and the organization shall not

(a) engage in any act of self-dealing as defined in IRC 4941(d)

(b) retain any excess business holdings as defined in IRC 4943(c)

(c) make any investments in such a manner as to subject the organization to tax under IRC 4944, or

(d) make any taxable expenditures as defined in IRC 4945(d) or corresponding provisions of any subsequent Federal tax laws.

Connie Brow, Chairperson 7/30/96 (July 30, 1996)

George H. Gromley, Council Member 7/30/96 (July 30, 1996)

Document 04: N-09089 Traditional Abenaki of Mazipskwik P.O. Box 309 Highgate Center, Vermont 05459. Dated May 16, 1999.

Dear Sir:

The Traditional Abenaki of Mazipskwik and Related Bands had tribal elections on May 15, 1999. The following changes in our administration are as follows:

Chairperson: Ronald Iacobucci

New Tribal Council members:

Kat Westhaver,

Don Cota,

Michael Messier and

Mathew Iacobucci.

The two other Tribal Council members are Verna Weshaver and

David Gilman.

Other than the Chair person's position, the Tribal Council members do not have a special title.

Please send all of the correspondence to the tribal address at the top of the letter.

Thank you Sincerely, David Gilman.

Document 05: Letter from Charles Delaney P.O. Box 5862 Burlington, Vermont 05402 Telephone (802) 863-6002 to Ken VanWey, Bureau of Indian Affairs Telephone (202) 208-5196. Dated February 21, 2008.

Dear Mr. VanWey,

In regards to your phone call yesterday, outlining federal penalty for basket donations to museums and manufacture of Native American crafts is erroneous and in conflict with the Vermont state law and the Vermont Abenaki Native American Commission, given their amendment bills defining Abenaki ethnic heritage pending in the Vermont state legislature with the desire to work with federal statutes in conjunction with existing state law.

As a U.S. Citizen, Vermonter, and Mazipskwik Abenaki I ask your federal Department of Native American Arts and Crafts, B.I.A., U.S. Interior Department to cease and desist in the internal affairs of the Vermont state legislature and the Vermont State Abenaki Native American Commission.

Perhaps your intentions are ethical and in a perceived higher intention, but the federal involvement in the internal affairs of state government cannot be construed from here as anything short of being political and illegal. Please let the mechanisms of democratic state government work.

Having lived in Vermont with a family history of many generations, I cannot as this time comply with your request to give names of Abenaki persons who create Native arts and crafts. Do you realize what you are doing to the Abenaki community and relations of community in Vermont?

Please advise the Vermont attorney general's office, Hon. Griffin and Hon. Bill Sorrell, that their office is welcomed to work with the Vermont State Abenaki Native American Commission to ensure the legal integrity of all needs concerned.

As your servant, I only desire the working relationship between the federal, state, and Abenaki community. I look forward to your communications and helping your office in whatever way I can.

Sincerely, Charles Delaney - Megeso

(Megeso is the noun for Eagle in the Abenaki language)

Mazipskwik Abenaki

Document 06: Photograph (edited) of Charles "Megeso" Lawrence Delaney, son of Charles Lawrence Delaney and Carolyn Lavergne nee: Strauch.

Document 07: 104915 Abenaki Construction - Missisquoi Masonry, Incorporated. Located in Burlington, Chittenden County, Vermont. Date business began February 01, 1996. Kind of business being transacted: Masonry and Related Construction.

Incorporator: "Soaring Eagle" Charles Delaney II, P.O. Box 5862 in Burlington, VT. 05402.

Subscribed and sworn to before me this 7th day of February 1996 (February 7, 1996)

Filing Fee $20.00.

Document 08: Trade Name Re-Registration: File 0104915. Abenaki Construction - Missisquoi Masonry. Charles Delaney II - Megeso POB 5862 Burlington, VT 05402

Name of Owner(s) and Address:

Member 1: Charles Delaney II - Megeso 49 Leonard St. in Burlington, Vt, 05401-2705.

Registered agent in VT: Charles Delaney II - Megeso

Street address: 49 Leonard Street in Burlington, Vermont 05401-2705

Signature of applicant: Charles Delaney II - Megeso

Title: Sole Proprietor

Subscribed and sworn to before me on this 4 day of April 2006 (April 04, 2006).

Filing fee is $40.00