Articles of Associaton for Wobanaki, Inc. The initial registered agent shall be Miles Jensen, with registered office at P.O. Box 276 in Swanton, Vermont 05488. The period of duration shall be perpetual. The corporation is organized for the purpose of:

1. This non-profit corporation is organized to improve the educational, health, social and economic status of Native Americans living in or having their historical heritae or some significant part thereof in the State of Vermont, including for such purposes, the making of distributions to organizations that qualify as exempt organizations under Section 501(c)3 of the Internal Revenue Code of 1954 (or the corresponding provision of any future United States Internal Revenue Law).

2. To maintain and disseminate information regarding traditional Native American cultural and social values, including language, arts and crafts and other aspects of Native American life, both past and present.

3. To recieve gifts of money, securities and real property and to otherwise acquire and hold, lease, rent, sell, and mortgage real and personal property for the purposes and objectives of the corporation.

4. To construct buildings and excavate or contract for the construction of buildings and excavation of work, or to contract and let contractors do such work.

5. To recieve gifts, grants or aid from Federal, State or Municipal Governments, school districts, or private citizens, including businesses, and to participate in any federal, state or school district educational or craft project.

6. To do any and all other acts as are permitted non-profit corporations under and by virtues of the laws of the State of Vermont as set forth in Title 11, Section 2352, Vermont Statutes Annotated specifically and Title 11, Chapter 19, Vermont Statutes Annontated generally.

7. No part of the net earnings of the corporation shall inure to the benefit of, or be distributed to its members, trustees, officers or other private persons, exceptthat the corporation shall be authorized and empowered to pay reasonable compensation for services rendered and to make payments and distributions in furtherance of the purposes set forth above relating to purposes and objectives of the corporation. No substantial part of the activities of the corporation shall be the carrying on of propaganda, or otherwise attempting to influence legislation, and the corporation shall not participate in, or intervene in (including the publishing or distribution of statements) any political campaign on behalf of any candidate for public office. Notwithstanding any other provision of these Articles of Association, the corporation shall not carry on any other activities no permitted to be carried on (a) by a corporation exempt from federal income tax under Section 501(c)3 of the Internal Revenue of 1954 (or the corresponding provision of any future United States Internal Revenue Code of 1954 (or the corresponding provision of any future United States Internal Revenue Law).

8. In the event of dissolution of the corporation for any cause or purpose, all assets remaining after the payment of bills outstanding and expenses incurred in terminating the corporation's the Abenaki Self-Help Association, Inc. or it's successor if it is a qualified corporation or to a non-profit corporation that would qualify under Section 501(c)3 of the Internal Revenue Code. Subject to the foregoing dissolution of the corporation shall be governed by the provisions of Title 11, Chapter 19, Subchapter 7, Vermont Statutes Annotated.

9. All of the powers enumerated above shall be exercised exclusively in furtherance of the purposes and objectives set forth above in such a manner that the corporation shall qualify as an exempt organization under Section 501(c)3 of the Internal Revenue Code of 1954 (or the corresponding provisions of any future United States Internal Revenue Law).

10. A trustee may be removed by the affirmative vote of not less than four trustees whenever in the judgement of the Board of Trustees the best interests of the corporation will be served thereby. A trustee prior to the vote on his removal shall be entitled to a public hearing before the Board of Trustees at which time he shall be entitled to make a statement on his behalf, present witnesses on his behalf and to have the assistance of counsel in connection with such activities.

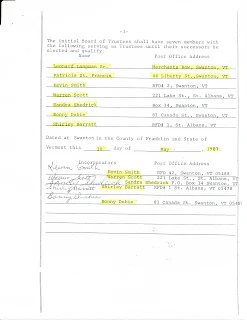

The initial Board of Trustees shall have seven members with the following serving as Trustees until their successors be elected and qualify:

Leonard Lampman Sr. at Merchants Row in Swanton, Vermont

Patricia St. Francis at 44 Liberty Street in Swanton, Vermont

Kevin Smith at RFD#2 in Swanton, Vermont

Warren Scott at 221 Lake Street in St. Albans, Vermont

Sandra Shedrick at Box 34 in Swanton, Vermont

Bonny Dubie at 81 Canada Street in Swanton, Vermont

Shirley Barratt at RFD#1 in St. Albans in Vermont

Dated at Swanton in the County of Franklin and State of Vermont this 10 day of May, 1983 (May 10, 1993).

Incorporators:

Kenvin Smith at RFD #2 in Swanton, Vermont 05488

Warren Scott at 221 Lake Street in St. Albans, Vermont

Sandy Shedrick (Sandra Shedrick) at P.O. Box 34 in Swanton, Vermont

Shirley Barratt at RFD #1 in St. Albans, Vermont 05478

Bonny Dubie at 81 Canada Street in Swanton, Vermont 05488