We, the undersigned, do hearby voluntarily associate ourselves together to form and establish a non-profit corporation, under the provisions of Title 11, Chapter 19, of the Vermont Statutes Annotated, as amended, and have hereby adopted the following Articles of Association, viz:

Artile 1: Name. The name of this non-profit corporation (hereinafter called "Corporation") shall be: Abenaki Self-Help Association, Inc.

Article 11: Duration. The term of existence of this Corporation shall be perpetual.

Article 111: Purposes. The purposes for which this Corporation is formed are exclusively charitable, benevolent, and educational and consist of the following: 1. To raise the economic, educational, and social conditions of those native Americans of Abenaki descent residing in Vermont and related areas; to foster and promote interest and concern for the Abenaki Indian heritage both within and without the Abenaki nation; to work for the elimination of prejudice, discrimination, and racial tension involving native americans; to lessen sickness and poverty within the Abenaki populace; and to expand educational and economic opprotunities for Abenakis.

2. To expand the opprotunities available to Abenakis to own, manage, and operate business enterprises by furthering the development of locally-owned or locally-operated business enterprises; to assist in developing entrepreneurial and management skills necessare for the financial support for the successful operation of business enterprises; and to assist in obtaining such financial support from other sources. 3. To expand the opprotunities available to Abenakis to obtain adequate housing accommodations. 4. To provide informational, outreach, and technical assistance to Abenakis which will assist those persons in acquiring such necessities of life as food, energy, and medical care. 5. To do any and all lawful activities which may be necessary, useful, or desirable for the furtherance, accomplishment, fostering, or attainment of the foregoing purposes, either directly or indirectly, and either alone or in conjunction or cooperation with others, whether such others be persons or organizations of any kind or nature, such as corporations, firms, associations, trusts, institutions, foundations, or governmental bureaus, departments or agencies.

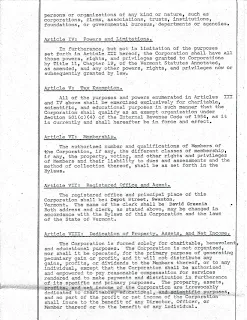

Article IV: Powers and Limitations. In furtherance, but not in limitation of the purposes set forth in Article III hereof, the Corporation shall have all those powers, rights, and privileges granted to Corporations by Title II, Chapter 19, of the Vermont Statutes Annotated, as amended, and any other powers , rights, and privileges now or subsequently granted by law.

Article V: Tax Exemption. All of the purposes and powers enumerated in Articles III and IV above shall be exercised exclusively for charitable, scientific, and educational purposes in such a manner that the Corporation shall qualify as an exempt organization under Section 501(c)(4) of the Internal Revenue Code of 1954, as it is currently and shall hereafter be in force and effect.

Article VI: Membership. The authorized number and qualifications of Members of the Corporation, if any, the different classes of membership, if any, the property, voting, and other rights and privileges of Members and their liability to dues and assessments and the method of collection thereof, shall be set forth in the Bylaws.

Article VII: Registered Office and Agent. The registered office and principal place of this Corporation shall be: Depot Street, Swanton, Vermont. The name of the clerk shall be David Greenia Both address and clerk, as stated above, may be changed in accordance with the Bylaws of this Corporation and the laws of the State of Vermont.

Article VIII: Dedication of Property, Assets, and Net Income. The Corporation is formed solely for charitable, benevolent, and educational purposes. The Corporation is not organized, nor shall it be operated, for the primary purpose of generating pecuniary gain or profit, and it will not distribute any gains, profits, or dividends to the Members thereof, or to any individual, except that the Corporation shall be authorized and empowered to pay reasonable compensation for services rendered and to make payments and distribution in furtherance of its specific and primary purposes. The property, assets, profits, and net income of the Corporation are irrevocably dedicated to charitable, educational, and scientific purposes, and no part of the profit or net income of the Corporation shall inure to the benefit of any Director, Officer, or Member thereof or to the benefit of any individual.

Article IV: Directors. Except as otherwise provided by law, or in a Bylaw or Bylaws of the Corporation not inconsistent with the provisions of these Articles of Association, all the affairs of the Corporation shall be managed and all powers of the Corporation shall be exercised by the Board of Directors composed of seven members. The term and qualifications of the Directors and the manner of their elections shall be as provided in the Bylaws. The initial Board of Directors shall consist of seven Directors and the names and addresses of the persons who are to serve as the initial Directors of the Corporation until the election and qualifications of their successors in a manner as set forth in the Bylaws of the Corporation are:

Janet Hurlbert at RFD 1 in Swanton, Vermont

Georgianna Martel at Lamkin Street in Highgate Center, Vermont

Patricia St. Francis at 44 Liberty Street in Swanton, Vermont

Alma Wells at 28 Liberty Street in Swanton, Vermont

Joy Mashtare at Canada Street in Swanton, Vermont

Simonne Bray at Highgate Falls, Vermont

Veronica St. Francis at Highgate Springs, Vermont

Article X: Amendment of Articles of Association. These Articles of Association may be altered or amended at any regular meeting or at any special meeting called for that purpose. An amendment must be approved by a majority of the Direcotrs and adopted by a vote of two-thirds (2/3rds) of the Members, if any, as such a meeting. Amendments to these Articles of Association when so adopted, shall be filed in accordance with the provisions of the Title 11, Chapter 19, of the Vermont Statutes Annotated, as amended.

Article XI: Incorporator. The name and adresses of the Incorporators of this Corporation are: Janet Hurlbert, RFD 1, Swanton, Vermont; Georgianna Martel, Lamkin Street, Highgate Center, Vermont

IN WITNESS HEREOF, we, the undersigned, being the persons named as the Incorporators, have executed these Articles of Association this 29th day of Oct, 1976.

Witnessed by:

Homer St. Francis

Wayne Hoague

Incorporator:

Georgiana J. Martel

Janette P. Hurlburt

OATH OF ARTICLES

We, the undersigned, subscribers of the aforesaid Articles of Association, do hereby subscribe to the truth of the foregoing Articles and that they constitute the Articles of Association of the Corporation formed.

Signed, Homer St. Francis, Wayne J. Hoague

STATE OF VERMONT-FRANKLIN COUNTY) SS. At Swanton in said County, on this 29th day of October, 1976, personally appeared the said Georgianna Martel and Janet Hurlbert and they made oath to the truth of the foregoing Articles of Association. Before me, Francis S. Harrington, Notary Public.

ARTICLES OF AMENDENT of ABENAKI SELF-HELP ASSOCIATION, INC.

a corporation organized and existing under the laws of State of Vermont, and having its registered office at Swanton in the county of Franklin in said state, did hold a meeting of the shareholders of said corporation duly called for such purpose on the 14 day of May, 1978, did vote to amend its Articles of Association as follows: That "Article III: Purposes" be amended by adding to the following sub-paragraph "6. To received any and all land and real estate donated, given or decreed by a Vermont Probate Court in accordance with any conditions and/or restrictions contained in any conveyance or bequest, including in perpetuity, and always receiving said gift or gifts and maintaining said land and real estate in a manner consistent with the express ecological aims and desires of the donors and testators."

At the time of the holding of the meeting, there were 247 members entitled to vote. The number of members voting against such amendment were none. Dated at Swanton in the County of Franklin this 14 day of May, 1978. President or Vice-President: James H. Ledoux; Secretary: Patricia St. Francis.

File No. 22844 AMENDMENT of ARTICLES OF ASSOCIATION of the (Non-Profit) $10 STATE OF VERMONT Office of Secretary of State Filed and recorded Apr 16, 1979.

ABENAKI SELF HELP ASSOCIATION, INCORPORATED. We, THE UNDERSIGNED, President and Clerk of ABENAKI SELF HELP ASSOCIATION, INCORPORATED a non-profit Corporation having no capital stock, organized and existing under the laws of the State of Vermont, and having its principal office at Swanton, in the County of Franklin in the State, hereby certify that at a meeting of the trustees (directors) of said corporation, duly called for that purpose, and held at SWANTON in the County of FRANKLIN, in the State, on the 9th day of April 1979, it was voted by three-fourths of all the directors or trustees of said corporation to amend to amend its articles of association as follows, viz: That Article V: Tax Exemption be ammended to read: All of the purposes and powers enumerated in Articles III and IV above shall be exercised exclusively for charitable, scientific, and educatioinal purposed in such manner that the Corporation shall qualify as an exempt organization under Sectioin 501(c)3 of the Internal Revenue Code of 1954, as it is currently and shall hereafter be in force and effect. Dated at Swanton, in the County of Franklin this 9th day of APRIL A.D. 1979. President: Leonard Lampman. Clerk: Connie Partlow.

STATE OF VERMONT, Franklin County, ss.} At Swanton in said County, this 9th day of April, 1979, personally appeared the above named Leonard Lampman, President and Connie Partlow Clerk of the corporation above named, and made oath to the truth of the foregoing certificate by them, subscribed. Louise E. Jensen, Notary Public.

This latter document from the Secretary of Vermont Website regarding ASHAI, Inc. ~and~ April St. Francis-Merrill's so-called "Tribal Council" LINK: http://www.abenakination.org/contactus.html

COMPARE the names of this so-called "Tribal Council" and Wobanaki, Inc.

1+1=2 and 2+2=4........